All Categories

Featured

Table of Contents

This is no matter of whether the insured person passes away on the day the plan begins or the day before the policy ends. A degree term life insurance coverage plan can match a large array of conditions and requirements.

Your life insurance policy plan can likewise create component of your estate, so could be subject to Estate tax found out more about life insurance coverage and tax - Term life insurance for couples. Let's consider some attributes of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life Insurance Policy), or 67 (with Important Health Problem Cover)

The quantity you pay remains the exact same, yet the degree of cover minimizes roughly in line with the means a settlement mortgage lowers. Lowering life insurance coverage can help your liked ones remain in the family members home and avoid any type of further interruption if you were to pass away.

If you choose level term life insurance policy, you can allocate your premiums because they'll stay the exact same throughout your term. Plus, you'll understand precisely just how much of a survivor benefit your recipients will certainly get if you die, as this amount will not change either. The rates for level term life insurance policy will certainly depend upon several aspects, like your age, health status, and the insurer you pick.

When you go with the application and medical test, the life insurance coverage company will examine your application. Upon authorization, you can pay your initial premium and authorize any kind of relevant documents to ensure you're covered.

What is Term Life Insurance For Spouse? How It Works and Why It Matters?

You can select a 10, 20, or 30 year term and appreciate the included peace of mind you should have. Functioning with an agent can help you find a plan that functions finest for your requirements.

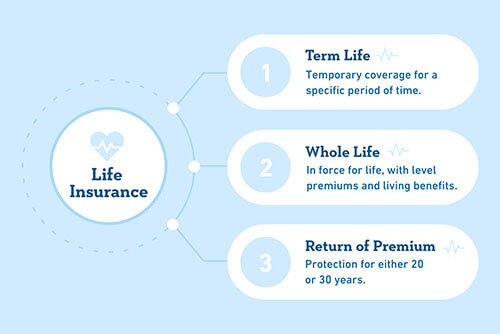

As you seek methods to safeguard your economic future, you have actually likely discovered a large range of life insurance policy options. Picking the right protection is a big choice. You wish to discover something that will certainly assist sustain your liked ones or the reasons vital to you if something happens to you.

What Makes 10-year Level Term Life Insurance Stand Out?

Many individuals lean towards term life insurance policy for its simplicity and cost-effectiveness. Level term insurance coverage, nonetheless, is a type of term life insurance policy that has consistent repayments and an imperishable.

Level term life insurance policy is a part of It's called "degree" because your costs and the benefit to be paid to your liked ones continue to be the very same throughout the contract. You will not see any adjustments in price or be left wondering about its worth. Some agreements, such as every year renewable term, might be structured with costs that enhance with time as the insured ages.

Repaired death advantage. This is likewise set at the start, so you can know specifically what death benefit quantity your can expect when you pass away, as long as you're covered and up-to-date on costs.

You agree to a fixed costs and fatality advantage for the period of the term. If you pass away while covered, your fatality benefit will be paid out to loved ones (as long as your premiums are up to date).

What is Level Term Life Insurance Policy Coverage?

You may have the alternative to for an additional term or, much more likely, renew it year to year. If your agreement has actually an assured renewability provision, you may not need to have a brand-new medical test to maintain your insurance coverage going. Nevertheless, your premiums are most likely to increase because they'll be based upon your age at revival time.

With this alternative, you can that will certainly last the rest of your life. In this case, once again, you might not require to have any type of new clinical examinations, however costs likely will climb as a result of your age and brand-new coverage (30-year level term life insurance). Different business use numerous choices for conversion, make certain to comprehend your choices prior to taking this action

Many term life insurance is level term for the period of the agreement duration, yet not all. With reducing term life insurance policy, your fatality advantage goes down over time (this kind is often taken out to particularly cover a long-term debt you're paying off).

And if you're established for sustainable term life, after that your costs likely will increase each year. If you're discovering term life insurance policy and want to ensure straightforward and predictable economic defense for your family members, degree term might be something to consider. However, as with any kind of sort of protection, it may have some constraints that don't satisfy your demands.

All About Life Insurance Coverage

Usually, term life insurance is more cost effective than permanent protection, so it's a cost-effective method to safeguard monetary security. Adaptability. At the end of your contract's term, you have multiple choices to proceed or move on from insurance coverage, often without requiring a medical examination. If your spending plan or coverage needs adjustment, survivor benefit can be minimized in time and outcome in a reduced costs.

As with other kinds of term life insurance, when the contract ends, you'll likely pay higher premiums for coverage because it will recalculate at your existing age and health. If your monetary situation modifications, you might not have the essential coverage and might have to purchase additional insurance coverage.

However that doesn't indicate it's a fit for everybody (Term life insurance with accidental death benefit). As you're buying life insurance policy, here are a couple of key factors to take into consideration: Budget. Among the benefits of degree term coverage is you understand the price and the fatality benefit upfront, making it simpler to without fretting regarding rises in time

Age and wellness. Usually, with life insurance, the healthier and younger you are, the more economical the coverage. If you're young and healthy and balanced, it might be an appealing alternative to secure in reduced premiums now. Financial duty. Your dependents and economic responsibility play a function in determining your protection. If you have a young household, for circumstances, level term can aid offer monetary assistance throughout important years without spending for coverage much longer than required.

Latest Posts

Monumental Life Final Expense

End Of Life Insurance Quotes

Best Final Expense Companies To Work For