All Categories

Featured

Table of Contents

Insurer will not pay a small. Rather, think about leaving the money to an estate or depend on. For more thorough info on life insurance policy obtain a duplicate of the NAIC Life Insurance Policy Customers Overview.

The IRS places a limit on exactly how much cash can go right into life insurance policy premiums for the plan and how promptly such premiums can be paid in order for the policy to preserve all of its tax benefits. If specific restrictions are exceeded, a MEC results. MEC insurance holders may go through tax obligations on circulations on an income-first basis, that is, to the degree there is gain in their plans, in addition to fines on any type of taxed quantity if they are not age 59 1/2 or older.

Please note that outstanding lendings build up rate of interest. Revenue tax-free therapy additionally thinks the loan will become satisfied from earnings tax-free survivor benefit proceeds. Fundings and withdrawals minimize the plan's cash money value and death benefit, might create specific plan advantages or motorcyclists to end up being inaccessible and may boost the opportunity the plan might lapse.

4 This is provided with a Long-term Care Servicessm rider, which is available for an added cost. Additionally, there are limitations and constraints. A customer may get approved for the life insurance coverage, however not the cyclist. It is paid as a velocity of the death advantage. A variable global life insurance policy contract is a contract with the main purpose of giving a survivor benefit.

Why do I need Final Expense?

These profiles are closely taken care of in order to satisfy stated investment purposes. There are fees and charges linked with variable life insurance policy contracts, including death and danger fees, a front-end lots, management fees, investment administration charges, abandonment costs and fees for optional riders. Equitable Financial and its affiliates do not give legal or tax suggestions.

Whether you're beginning a household or marrying, individuals generally begin to consider life insurance coverage when somebody else starts to rely on their capability to gain a revenue. And that's fantastic, because that's specifically what the fatality benefit is for. As you discover a lot more regarding life insurance policy, you're likely to locate that several policies for instance, whole life insurance policy have greater than simply a survivor benefit.

What are the advantages of whole life insurance policy? Below are a few of the vital things you should understand. One of the most enticing benefits of purchasing an entire life insurance plan is this: As long as you pay your costs, your fatality benefit will never expire. It is guaranteed to be paid despite when you pass away, whether that's tomorrow, in five years, 80 years or perhaps additionally away. Family protection.

Believe you don't require life insurance policy if you do not have kids? You might want to believe once more. It may feel like an unnecessary cost. Yet there are lots of advantages to having life insurance, also if you're not sustaining a family members. Below are 5 reasons why you need to buy life insurance policy.

What does a basic Wealth Transfer Plans plan include?

Funeral costs, funeral prices and medical bills can accumulate (Wealth transfer plans). The last thing you desire is for your loved ones to shoulder this extra worry. Irreversible life insurance policy is readily available in various quantities, so you can pick a fatality advantage that fulfills your needs. Alright, this set just applies if you have children.

Figure out whether term or long-term life insurance policy is best for you. After that, get a price quote of how much coverage you might require, and just how much it could cost. Locate the best amount for your spending plan and peace of mind. Discover your amount. As your individual scenarios change (i.e., marital relationship, birth of a kid or work promotion), so will certainly your life insurance policy requires.

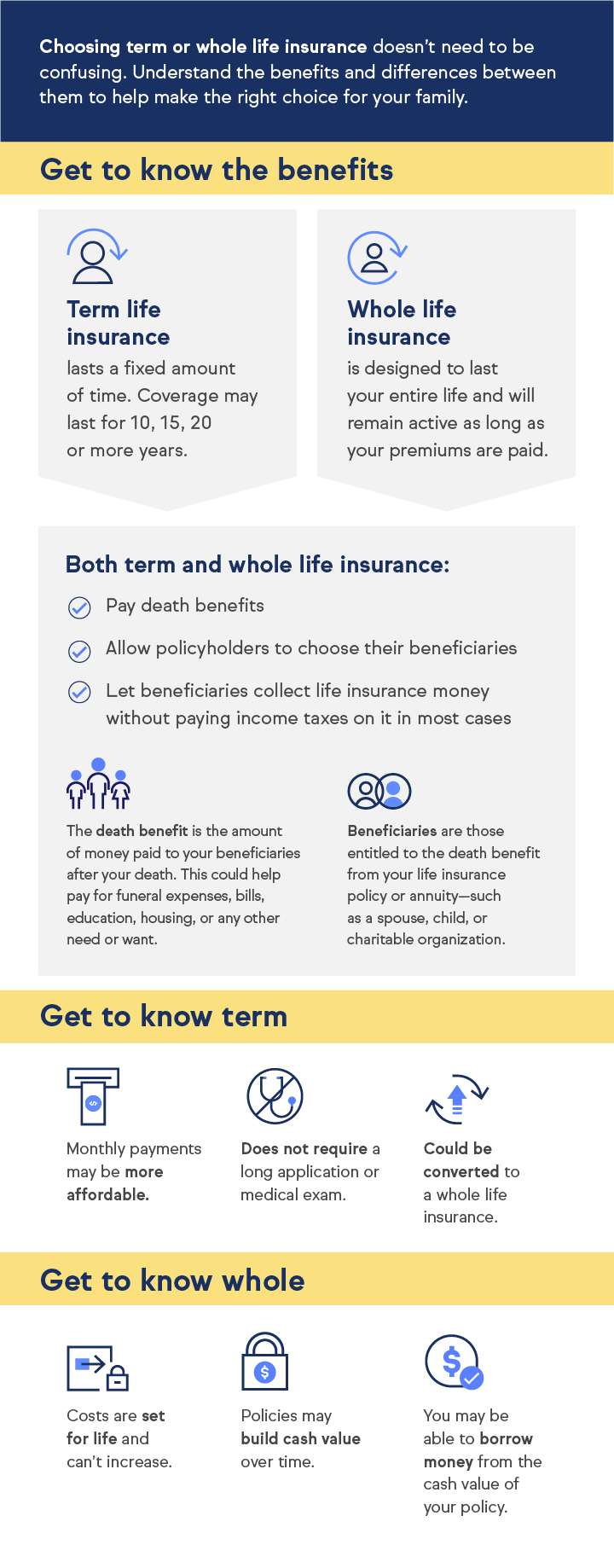

Generally, there are 2 kinds of life insurance prepares - either term or permanent plans or some mix of the two. Life insurance providers provide various kinds of term strategies and typical life plans in addition to "rate of interest sensitive" items which have actually become a lot more prevalent considering that the 1980's.

Term insurance coverage offers protection for a given amount of time. This period might be as brief as one year or provide coverage for a details number of years such as 5, 10, twenty years or to a specified age such as 80 or sometimes as much as the oldest age in the life insurance coverage mortality.

How do I cancel Policyholders?

Presently term insurance rates are extremely affordable and among the most affordable historically skilled. It needs to be noted that it is a widely held belief that term insurance is the least costly pure life insurance protection readily available. One needs to assess the plan terms very carefully to make a decision which term life choices appropriate to fulfill your specific scenarios.

With each brand-new term the costs is raised. The right to restore the plan without proof of insurability is a vital advantage to you. Or else, the risk you take is that your health might degrade and you may be incapable to acquire a policy at the very same rates or perhaps at all, leaving you and your beneficiaries without coverage.

You should exercise this option throughout the conversion period. The size of the conversion period will certainly differ depending on the sort of term plan bought. If you transform within the proposed period, you are not needed to provide any details about your health. The premium price you pay on conversion is generally based upon your "current attained age", which is your age on the conversion day.

Under a level term plan the face amount of the policy remains the exact same for the whole duration. Commonly such plans are offered as mortgage protection with the quantity of insurance policy lowering as the equilibrium of the home mortgage decreases.

How long does Long Term Care coverage last?

Traditionally, insurance companies have actually not can alter premiums after the plan is marketed. Because such policies might continue for several years, insurance providers have to make use of conservative death, rate of interest and cost rate quotes in the costs calculation. Flexible premium insurance coverage, nonetheless, enables insurance providers to use insurance at reduced "existing" costs based upon less conventional assumptions with the right to change these premiums in the future.

While term insurance is designed to supply security for a defined period, irreversible insurance coverage is developed to provide protection for your whole lifetime. To maintain the premium price level, the premium at the younger ages surpasses the actual expense of security. This extra costs constructs a reserve (money value) which aids pay for the policy in later years as the price of defense increases above the costs.

The insurance policy company invests the excess premium bucks This type of policy, which is occasionally called money worth life insurance, produces a financial savings aspect. Cash money worths are important to an irreversible life insurance plan.

Latest Posts

Funeral Insurance Companies In Usa

Monumental Life Final Expense

End Of Life Insurance Quotes