All Categories

Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance policy policy that covers the insurance holder for a particular quantity of time, which is known as the term. The term lengths differ according to what the specific picks. Terms typically vary from 10 to 30 years and boost in 5-year increments, supplying level term insurance.

They commonly supply an amount of protection for much less than irreversible kinds of life insurance policy. Like any type of plan, term life insurance has advantages and downsides depending upon what will function best for you. The benefits of term life include affordability and the capability to tailor your term size and protection quantity based on your demands.

Relying on the type of policy, term life can use repaired premiums for the entire term or life insurance coverage on degree terms. The survivor benefit can be taken care of also. Level premium term life insurance policies. Since it's a budget friendly life insurance policy product and the settlements can remain the same, term life insurance policy plans are prominent with youngsters simply starting, households and people that want security for a particular amount of time.

*** Fees reflect policies in the Preferred Plus Price Class problems by American General 5 Stars My representative was very experienced and practical in the procedure. July 13, 2023 5 Stars I was satisfied that all my needs were fulfilled quickly and expertly by all the agents I spoke to.

What is 30-year Level Term Life Insurance? Pros, Cons, and Features

All paperwork was digitally finished with accessibility to downloading and install for individual file upkeep. June 19, 2023 The endorsements/testimonials presented need to not be understood as a referral to purchase, or a sign of the worth of any kind of services or product. The testimonies are actual Corebridge Direct clients that are not connected with Corebridge Direct and were not given payment.

There are several kinds of term life insurance policies. Instead of covering you for your entire lifespan like whole life or universal life plans, term life insurance policy only covers you for an assigned amount of time. Plan terms typically vary from 10 to three decades, although shorter and longer terms may be readily available.

A lot of generally, the policy ends. If you want to maintain insurance coverage, a life insurance company may offer you the choice to restore the policy for an additional term. Or, your insurer might permit you to transform your term plan to a irreversible plan. If you added a return of premium motorcyclist to your plan, you would receive some or every one of the cash you paid in premiums if you have actually outlasted your term.

Level term life insurance policy might be the ideal choice for those who desire insurance coverage for a collection time period and want their premiums to continue to be stable over the term. This might use to consumers worried regarding the cost of life insurance policy and those who do not desire to alter their death advantage.

That is since term policies are not ensured to pay out, while long-term policies are, gave all premiums are paid. Degree term life insurance coverage is normally more costly than reducing term life insurance, where the death advantage decreases with time. In addition to the sort of plan you have, there are numerous other aspects that aid establish the cost of life insurance policy: Older candidates normally have a higher mortality risk, so they are commonly a lot more costly to guarantee.

On the flip side, you might have the ability to safeguard a more affordable life insurance policy price if you open up the plan when you're younger. Similar to innovative age, bad health can likewise make you a riskier (and more costly) prospect permanently insurance policy. If the condition is well-managed, you may still be able to discover economical insurance coverage.

Is Level Term Life Insurance Definition a Good Option for You?

Health and age are normally much extra impactful premium elements than gender., may lead you to pay more for life insurance. High-risk jobs, like window cleaning or tree trimming, may likewise drive up your expense of life insurance policy.

The very first step is to determine what you need the plan for and what your spending plan is. Once you have an excellent idea of what you desire, you may want to compare quotes and plan offerings from a number of business. Some business provide online quoting forever insurance coverage, yet numerous need you to get in touch with an agent over the phone or personally.

1Term life insurance provides short-term security for a crucial period of time and is generally cheaper than irreversible life insurance policy. 2Term conversion standards and constraints, such as timing, might apply; for instance, there may be a ten-year conversion privilege for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance coverage Acquisition Option in New York. There is an expense to exercise this cyclist. Not all getting involved plan owners are eligible for dividends.

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year plans. The most preferred type is level term, meaning your payment (premium) and payout (survivor benefit) remains level, or the same, up until the end of the term period. term life insurance for seniors. This is the most uncomplicated of life insurance policy choices and needs very little upkeep for plan owners

As an example, you might give 50% to your partner and split the rest amongst your grownup children, a moms and dad, a buddy, or perhaps a charity. * In some instances the survivor benefit might not be tax-free, discover when life insurance is taxed.

What is Term Life Insurance For Seniors? Explained in Simple Terms?

There is no payment if the policy runs out prior to your fatality or you live beyond the policy term. You might be able to restore a term plan at expiration, however the premiums will be recalculated based upon your age at the time of renewal. Term life insurance coverage is generally the least pricey life insurance policy offered due to the fact that it offers a fatality benefit for a restricted time and doesn't have a cash money worth component like long-term insurance coverage - Level term life insurance.

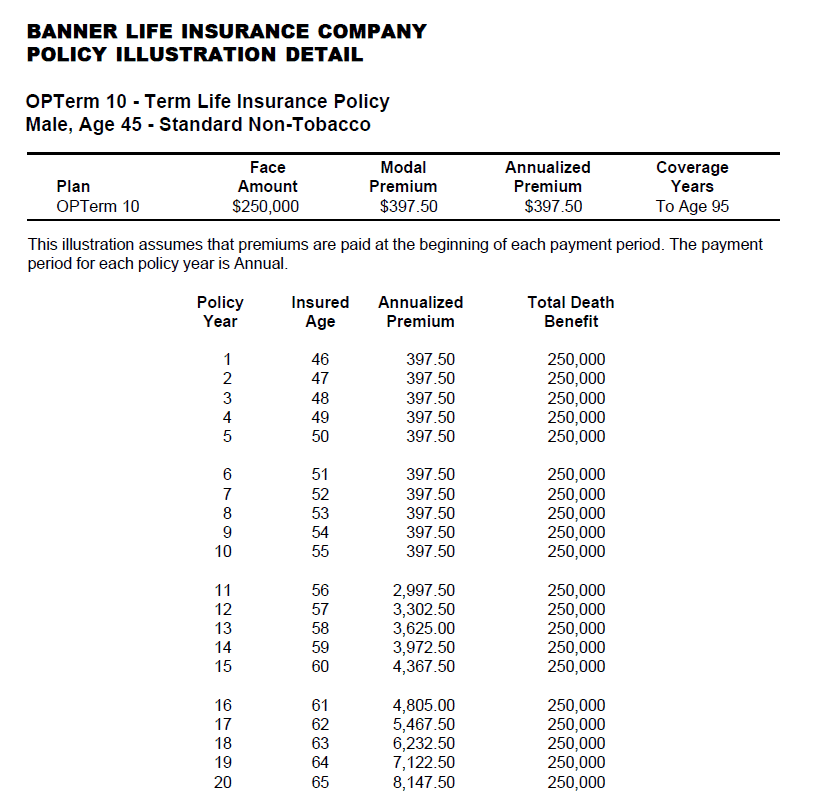

At age 50, the costs would climb to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 half a century old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in outstanding health and wellness. In contrast, right here's a take a look at rates for a $100,000 entire life policy (which is a kind of irreversible policy, implying it lasts your lifetime and includes cash worth).

The lower risk is one aspect that enables insurance firms to bill lower costs. Rates of interest, the financials of the insurer, and state policies can likewise affect costs. Generally, companies often use much better prices at the "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000. When you think about the amount of coverage you can obtain for your premium dollars, term life insurance policy often tends to be the least expensive life insurance policy.

Latest Posts

Funeral Insurance Companies In Usa

Monumental Life Final Expense

End Of Life Insurance Quotes